Recognition of churn

Learn how Fincome recognizes churn for precise MRR management. Explore the available options to track subscription cancellations.

1. What is churn?

Churn (or attrition) refers to the loss of customers or recurring revenue over a given period. Generally we distinguish churn by number of customers or “logo churn” (number of customers who unsubscribe) and churn by MRR value (amount of MRR lost due to unsubscribes). MRR is a key SaaS metric: any drop in MRR caused by churn reflects revenue attrition.

2. The different types of churn tracked in Fincome

Several churn indicators are available in Fincome to provide a comprehensive view of attrition: these metrics are notably found in the platform’s “Churn Rates” category. The main distinctions are:

Customer churn (logo churn) : the number of customers who have cancelled all their subscriptions over a period.

For example, if 5 customers out of 100 unsubscribe during the month, the customer churn for the month is 5% (customer attrition rate).

MRR churn : the amount of MRR lost due to customer churns over a period. It is often expressed as a percentage of the initial total MRR. This value-based churn rate highlights the financial impact of customer loss, complementary to churn measured by number of customers.

For example, if the MRR at the start of the month was €50,000 and €2,000 of MRR are lost due to churns, the MRR churn for the month is 4%.

MRR contraction: the amount of MRR lost due to reductions or downgrades without a complete loss of the customer. This is not churn strictly speaking (the customer is still active), but Fincome tracks it separately to analyze partial decreases in recurring revenue.

Gross churn vs net churn: Gross churn (whether by number of customers or by MRR) considers the total losses without accounting for offsets. Net churn, on the other hand, takes into account recoveries or expansions that could offset these losses.

Regardless of the type of churn, you can choose when the loss of a subscription or a customer is recorded in your metrics.

3. Options for recognizing churn

On the cancellation request date : Churn is recognized immediately on the date when the customer requests to cancel their subscription. For example, if a customer sends their cancellation request on June 10 (even if the service ends later), Fincome will record a churn dated June 10. This approach allows tracking churn as close as possible to the customer signal (unsubscribe request).

On the effective cancellation date : Churn is recognized on the effective end date of the subscription in the system, i.e. when the subscription is actually terminated. For example, if a subscription is scheduled to end on June 30, the MRR loss will be recorded on June 30, even if the request was made earlier. This option aligns churn with the actual contract end.

At the end of the last paid service period : Churn is recognized once the customer has used up the period already paid for. Concretely, Fincome will consider the end of the billed period as the churn date. For example, if a customer has paid their subscription through June 30, the churn will be dated June 30, regardless of whether the cancellation was requested earlier. This option ensures that churn is recorded at the moment when recurring revenue actually stops being received (end of the paid coverage).

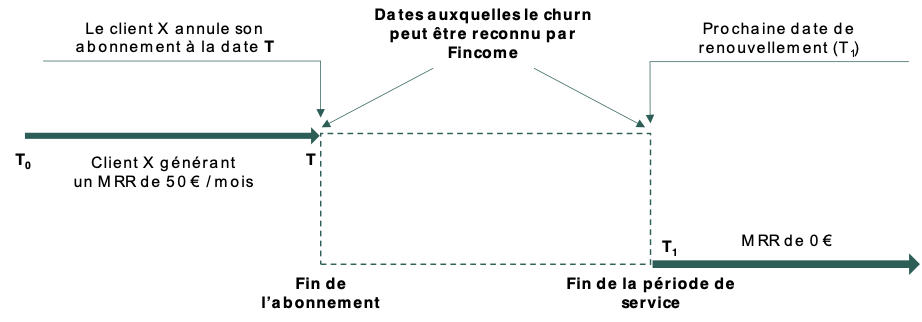

The diagram below describes these two possible options:

Thus, in the diagram above, customer X unsubscribes on date T, for example December 15, so their subscription ends on that date. However, in most cases customer X continues to receive the service until the end of the current month, i.e. until December 31. Fincome takes January 1 at midnight as the effective end date of the billing period, marking customer X’s churn in the month of January.

4. Special case: discount bringing MRR to zero (hidden option)

In some cases, an invoice of €0 (following a discount or an exceptional credit) can temporarily drop MRR to zero, without the customer actually having churned. By default, Fincome interprets this case as churn, since no active MRR is detected.

To avoid this false detection, an advanced option allows treating these cases as a contraction: the €0 MRR is recognized as a temporary revenue decrease, provided that an invoice is indeed present. The customer is then not counted as churned as long as the subscription remains active and the last invoice has not been cancelled.

This option only applies if an invoice exists. In the total absence of billing, the MRR is considered lost (churn).

Activating this option requires a manual intervention from Fincome support. Contact us if you would like to enable it so as not to skew your churn metrics in cases of €0 invoices.

Last updated