Recognizing churn

Understand churn recognition with Fincome. Choose between recognizing churn at cancellation or at the end of the billing period. Currently, only end-of-period recognition is available.

This article covers possible churn recognition options and presents the 2 churn recognition options available in Fincome.

Fincome offers two main options for recognizing churn:

at the time of cancellation: churn is recognized at the time the subscription is cancelled or expires in your billing system. This option gives you a real-time view of your forecast MRR, and comes close to the concept of CMRR.

at the end of the period of service rendered: churn is recognized at the end of the subscription's current billing period, even if the subscription has already been cancelled in your billing system. This option is considered the best practice for fine-tuning your invoiced MRR.

For the moment, only the second option is available in Fincome, but we are actively working to offer you the first option as well (often the cause of discrepancies you may observe with the MRR indicated by Stripe).

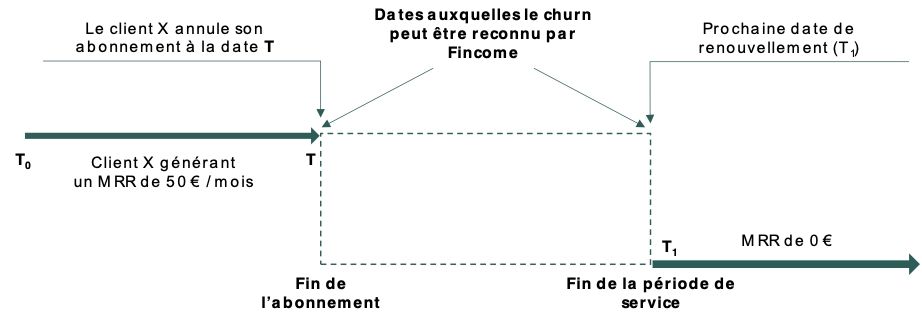

The diagram below describes these two possible options:

So, in the diagram above, customer X unsubscribes on date T, for example December 15, so his subscription ends on that date. On the other hand, in the majority of cases, customer X benefits from the service until the end of the current month, i.e. until December 31st. Fincome takes January 01 at midnight as the effective date of the end of the billing period, materializing customer X's churn for the month of January.

Please do not hesitate to contact Fincome support for any further information.

Dernière mise à jour