Fincome data vs invoicing data

Understand Fincome data vs invoicing data for accurate MRR tracking. Explore differences in MRR calculation, customer count, and settings to resolve discrepancies.

Mis à jour

Understand Fincome data vs invoicing data for accurate MRR tracking. Explore differences in MRR calculation, customer count, and settings to resolve discrepancies.

Mis à jour

Tracking MRR is essential for businesses with a recurring revenue model, particularly for assessing the health of your business on a regular basis.

Calculating MRR may seem straightforward, and can be easily accessed on platforms such as Stripe or Chargebee, but it's an indicator that requires a great deal of precision to be reliable and useful, and that's the whole point of the Fincome solution. There may be differences between the MRR figures from your billing system and those from Fincome.

These variations are explained by the way in which each billing system determines recurring revenue.

In this article, we detail the main differences and provide the resources to help you understand the discrepancies you're seeing, including differences in :

MRR

number of customers

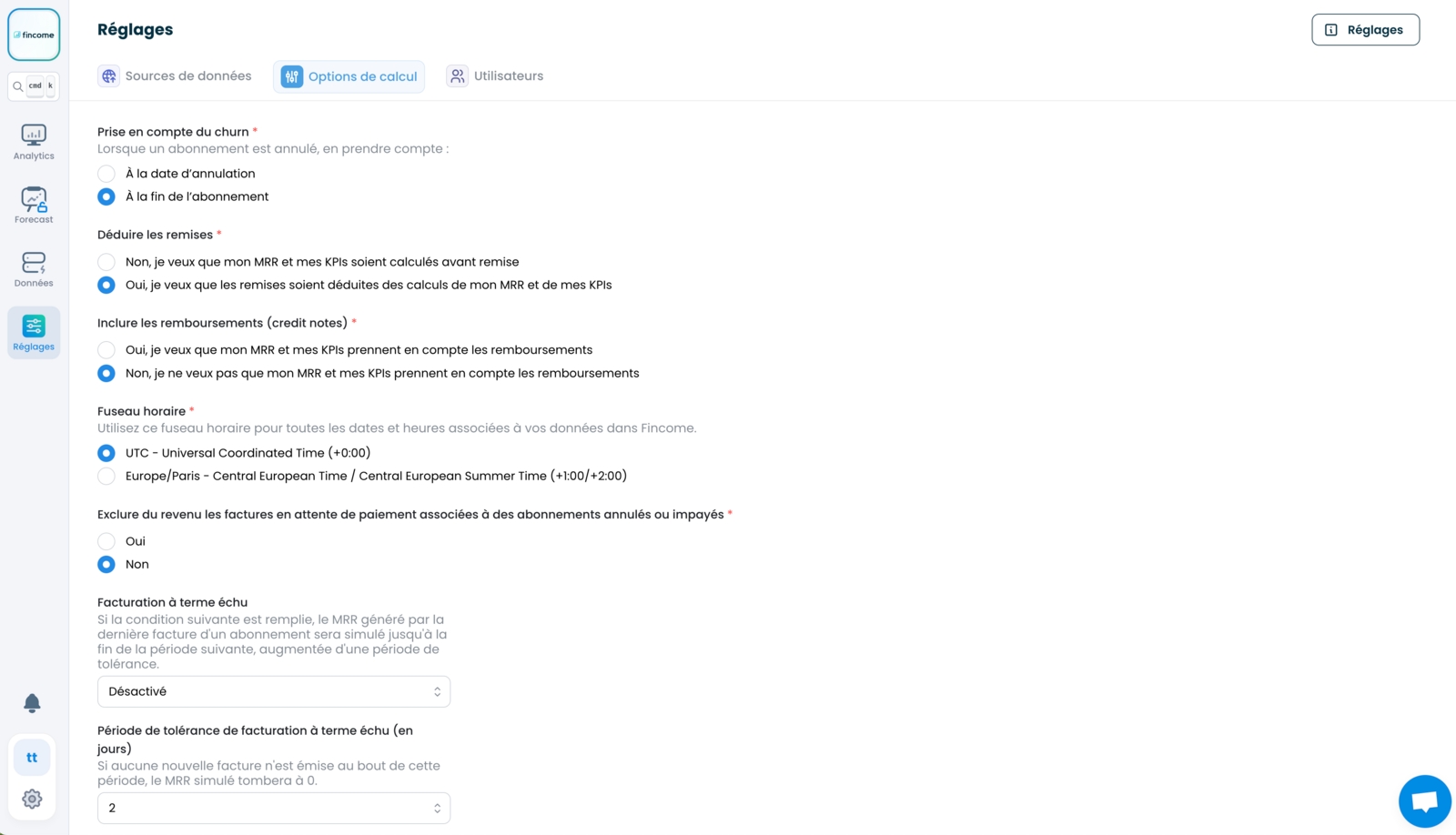

First and foremost, the calculation of your Fincome metrics can be adjusted according to certain parameters. The choice of these parameters may depend on the way you bill, or on your preferences regarding the way you analyze your metrics. To adjust these parameters, go to "Settings" > "Calculation options".

The MRR from your billing system may differ from what you see in Fincome due to the way the data is processed. We have listed the most common reasons below:

Recognition of unsubscribes may differ depending on how your billing system handles cancellations, which may result in differences in the calculation of MRR. Please refer to the article on churn recognition.

By default, Fincome deducts discounts from the MRR calculation to present a net MRR. This MRR is generally recognized as being more representative of the company's activity. However, you can configure the MRR calculation and KPIs to exclude the impact of discounts in the "Settings" section of the platform.

Of the various billing systems, only Stripe deducts refunds from the calculation of the MRR. For all other billing systems, refunded transactions are not deducted from MRR. Fincome does not deduct refunds by default, but gives you the option of doing so in the "Settings" section if you use Stripe Billing or Chargebee.

Some billing systems exclude unsuccessful invoices from the MRR calculation. Stripe does so only if the last dunning attempt fails. Fincome includes them in the MRR calculation, even if a transaction is marked as failed, as long as an invoice has been issued and payment is due.

When one of your customers' invoices is paused, it is considered in Fincome as having expired. We're working on this to offer greater flexibility.

Non-recurring billing does not contribute to MRR in Fincome, however, your billing system may include non-recurring billing in the MRR calculation and thus generate a source of variances. Please refer to the article "What's the difference between MRR and Sales" for more details.

By default, Fincome does not include VAT or any other tax specified on invoices in the MRR calculation. Fincome does, however, give you the option of observing the MRR including VAT by selecting this parameter in the "settings" section.

As long as a customer is in a trial period and has not yet been invoiced for an amount greater than 0€, he is not captured in Fincome. When a customer has an overdue payment, Fincome assumes their good faith and they continue to contribute to the PPA.

The most common discrepancy in the number of customers is due to the fact that Fincome does not count customers who have not been invoiced. For a customer to be considered active and included in Fincome's customer count, the billing attributed to him or her must be greater than €0. Customers on a free trial or benefiting from a 100% discount therefore do not appear as paying customers in Fincome. Non-recurring customers contribute to the non-recurring income visible in the Non-recurring income section. When a customer has a late or failed payment, Fincome assumes their good faith and continues to count them as customers.